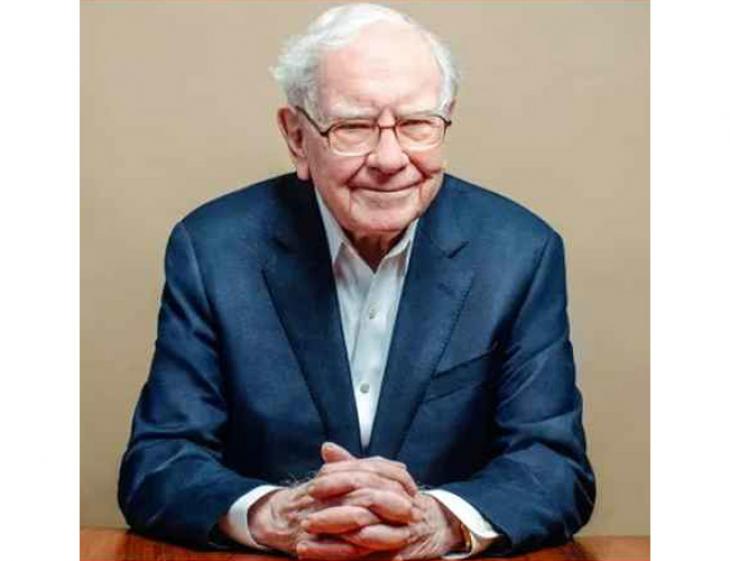

By Publisher Ray Carmen

In a world obsessed with the next big thing, Warren Buffett made his fortune — and his name , by embracing the old-school virtues: patience, discipline, and common sense.

He didn’t chase trends. He bet on timeless value.

And in doing so, he became one of the wealthiest and most respected investors in history — not just for what he built, but how he built it.

Berkshire Hathaway: The Empire of Simplicity

Buffett bought a failing textile mill in the 1960s. Today, that company — Berkshire Hathaway — is a $900+ billion conglomerate that owns or holds stakes in giants like Apple, Coca-Cola, American Express, and GEICO.

But this wasn’t Silicon Valley speed. It was Omaha wisdom.

Buffett famously reads for six hours a day, makes just a handful of investments each year, and avoids what he calls “the institutional imperative” — following the crowd for the sake of fitting in.

“Be fearful when others are greedy, and greedy when others are fearful.”

— Warren Buffett

While Wall Street zigged, Buffett zagged — and outperformed most of them for over half a century.

The Discipline of the Long Game

Buffett’s investing strategy is deceptively simple:

-

Understand the business

-

Believe in the leadership

-

Buy at a fair price

-

Hold… sometimes forever

He doesn’t trade. He builds. He trusts compound interest more than charisma.

His secret? Resisting emotion in a world driven by hype.

Even in crises — from Black Monday in 1987 to the Great Recession in 2008 — Buffett stayed calm, bought when prices dropped, and reminded investors that the best asset is time.

Integrity Over Image

Buffett never chased celebrity.

He still lives in the same modest house in Omaha he bought in 1958. He eats McDonald’s breakfasts. He prefers Coke over cocktails. And he writes his annual letters to shareholders with disarming clarity and wit — no corporate jargon, just common sense.

That humility made him not just a financial icon but a moral compass in an often-opaque industry.

The Philanthropic Giant

In 2006, Buffett pledged to give away over 99% of his wealth — most of it to the Bill & Melinda Gates Foundation.

Then, he co-founded the Giving Pledge, encouraging billionaires to commit at least half their wealth to good causes.

This wasn’t PR. It was purpose.

Buffett sees wealth as responsibility, not entitlement.

Conclusion: The Oracle’s Quiet Revolution

Warren Buffett didn’t invent a product, launch a platform, or rewrite code.

He proved that character can compound just like capital.

His genius wasn’t in what he bought — it was in what he believed: that value outlasts hype, integrity beats flash, and the best investment… is patience.